Our Funds

Sower’s Farmland Fund provides investors with access to U.S. agricultural real estate. Farmland provides unique investment characteristics and significant opportunities:

Diversification

- Low or negative correlations to stocks and bonds.

Higher Risk-Adjusted Returns

- For the past 25 years, real assets have delivered similar or higher returns than stocks with much lower volatility, resulting in higher Sharpe ratios.

Income Alternative & Growth Potential

- Bond-like current income potential from contractual lease obligations, selling commodities and long-term capital appreciation from rising land values.

Inflation Hedge

- Long-term returns have far outpaced the inflation rate.

- Many commodities, such as foodstuffs and raw materials, are components of inflation measures, such as the Consumer Price Index (CPI).

Asset Types

PRIME

VALUE ADD

STRATEGIC

FARM RELATIONSHIPS

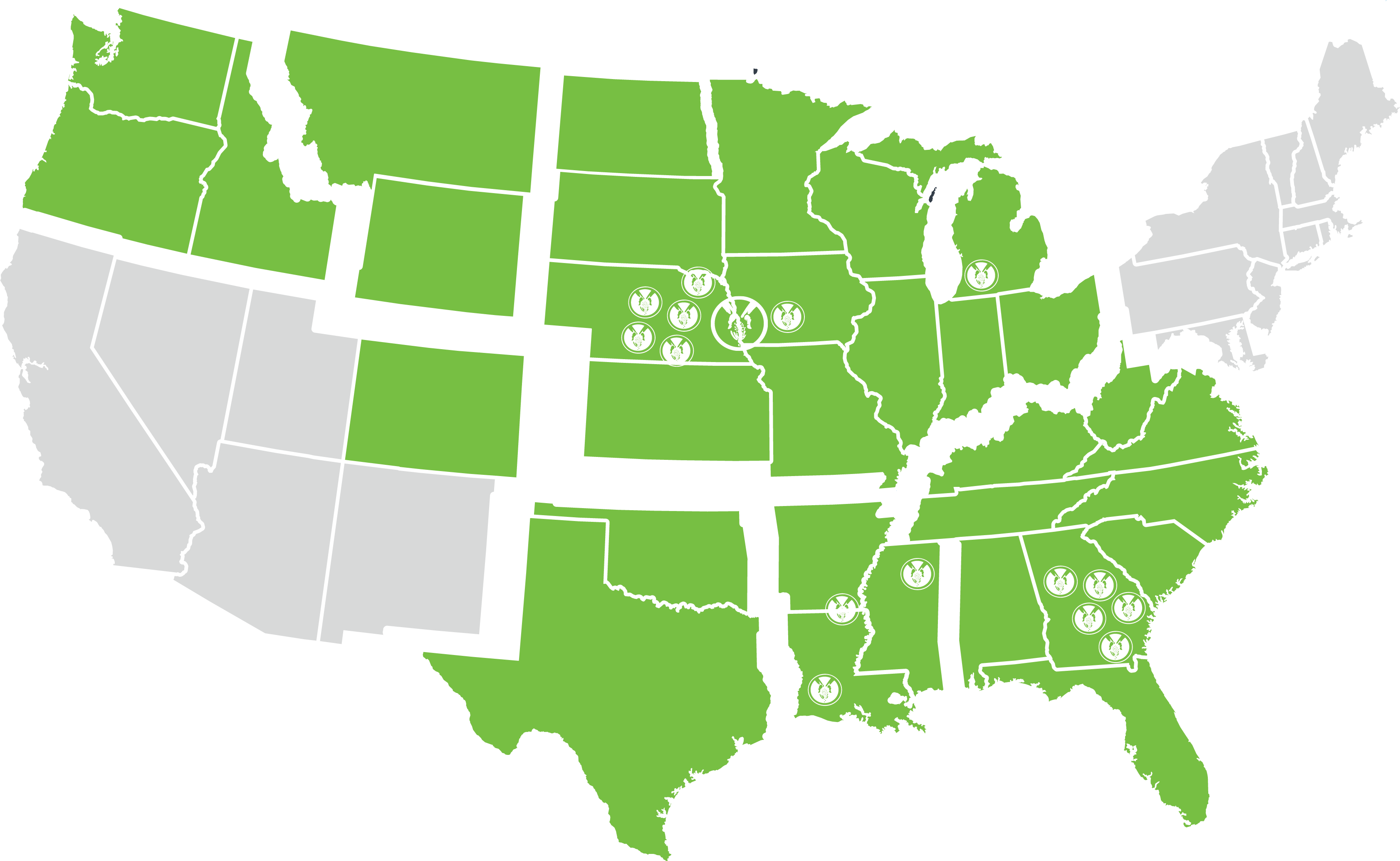

Contacts throughout the nation provide meaningful contributions to the value of Sower Farmland Fund.

Farmland Investing

Data from the National Council of Real Estate Investment Fiduciaries (NCREIF) shows farmland produced a positive return every year since 1998. Moreover, its average annual return in that time span was 11.2%.

FARMLAND RETURNS COMPARED TO VOLATILE S&P 500

Source: NCREIF, Haver Analytics; additionally, it is not possible to invest in a Farmland index. Performance for indices does not reflect investment fees or transaction costs.